META position adjustment for demo portfolio

In this video, I walk through a key adjustment I made to our Meta (META) bull call spread position. Originally set up as a 660/670 spread, I rolled it down to a 600/620 spread to increase the probability of success and maximize potential profit. I'll explain why I made this move, how it changes our risk/reward, and why adjusting options trades can be a powerful strategy in uncertain markets. Plus, I'll give an update on our overall portfolio performance compared to the S&P 500 and Nasdaq. Watch to learn how to adapt options trades for better outcomes! 🚀📈

🔹 Original Trade: 660/670 bull call spread

🔹 Adjustment: Rolled down to 600/620

🔹 Why? Higher probability & potential profit

🔹 Portfolio Update: Outperforming the market despite recent declines

Don't forget to like and subscribe for more real-world options trading insights!

A 90% probability of profit earnings play on ADBE

Earnings season is here, and ADBE is up next. With the market pricing in a 7.4% post-earnings move, I built a high-probability options play with a 91% chance of any profit. This strategy—combining a bull call spread and a put ratio spread—positions for upside while limiting downside risk, all for a net credit. As long as ADBE stays above $390 by expiration, it’s profitable, with a $1,000 max gain if ADBE pops above $450. Here’s the full breakdown of the trade and why it makes sense in the current market conditions. 🚀📈

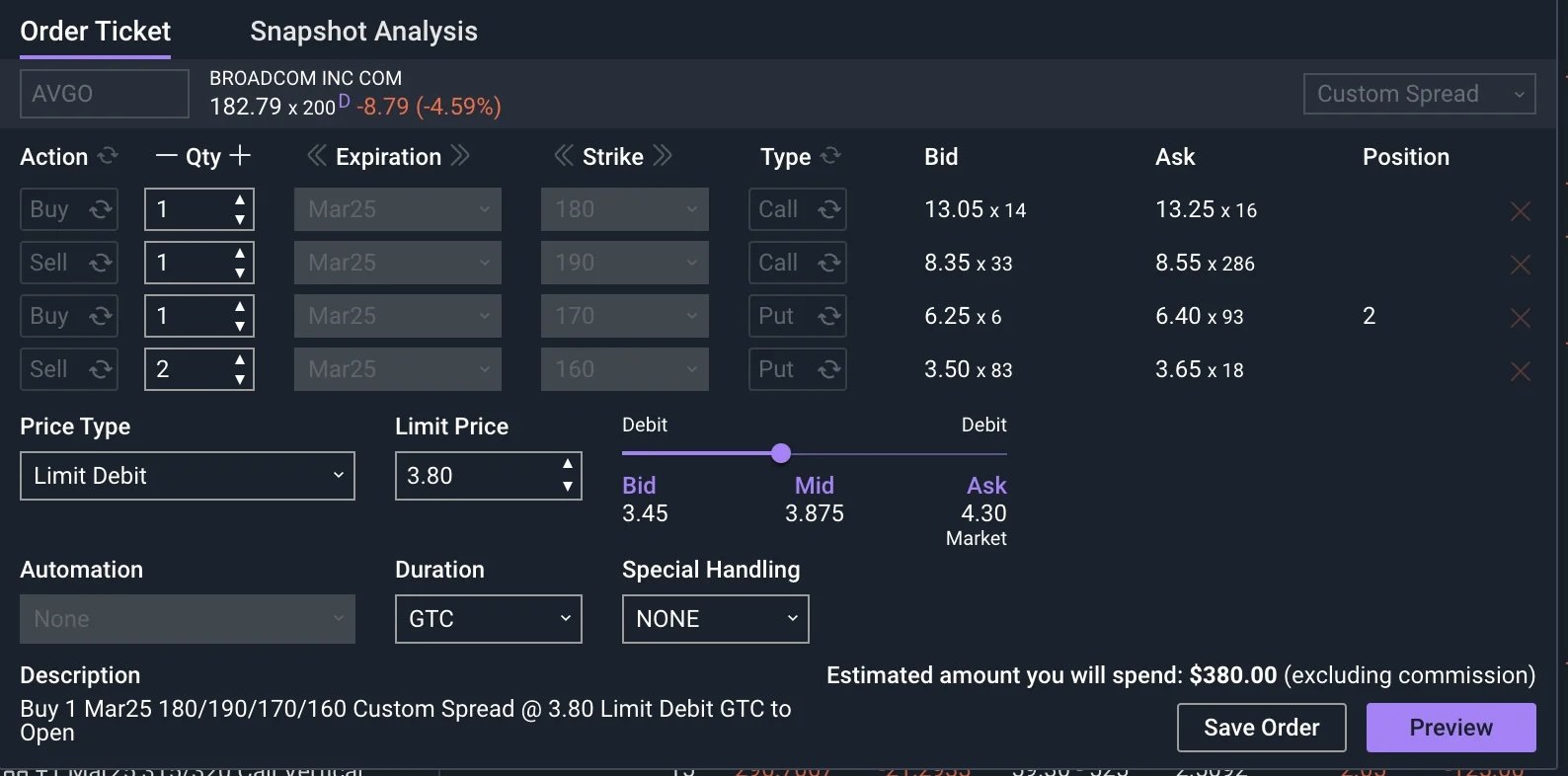

A couple of AVGO earnings options plays

Earnings season means opportunity—and risk. With AVGO down 25% from its highs and an implied move of 8.7%, I’m eyeing a high-probability strategy that profits whether AVGO pops or drops. Instead of gambling on a single direction, I’m combining a bull call spread with a put ratio spread for a potential $600 profit while keeping risk in check. If AVGO tanks, I have a plan for that too. Full breakdown inside—how are you playing AVGO earnings?