Green for the year - open portfolio update

Outperforming the Market Without a Single Trade? That’s exactly what happened — and it’s only halfway through the year. Here's how this portfolio is set to lock in $10K even if the market stalls.

Paper trading portfolio update

Come check out how our paper trade portfolio fared over the last 2 months of Trump craziness. Hint: its outperforming and on track to make >10%.

META position adjustment for demo portfolio

In this video, I walk through a key adjustment I made to our Meta (META) bull call spread position. Originally set up as a 660/670 spread, I rolled it down to a 600/620 spread to increase the probability of success and maximize potential profit. I'll explain why I made this move, how it changes our risk/reward, and why adjusting options trades can be a powerful strategy in uncertain markets. Plus, I'll give an update on our overall portfolio performance compared to the S&P 500 and Nasdaq. Watch to learn how to adapt options trades for better outcomes! 🚀📈

🔹 Original Trade: 660/670 bull call spread

🔹 Adjustment: Rolled down to 600/620

🔹 Why? Higher probability & potential profit

🔹 Portfolio Update: Outperforming the market despite recent declines

Don't forget to like and subscribe for more real-world options trading insights!

A 90% probability of profit earnings play on ADBE

Earnings season is here, and ADBE is up next. With the market pricing in a 7.4% post-earnings move, I built a high-probability options play with a 91% chance of any profit. This strategy—combining a bull call spread and a put ratio spread—positions for upside while limiting downside risk, all for a net credit. As long as ADBE stays above $390 by expiration, it’s profitable, with a $1,000 max gain if ADBE pops above $450. Here’s the full breakdown of the trade and why it makes sense in the current market conditions. 🚀📈

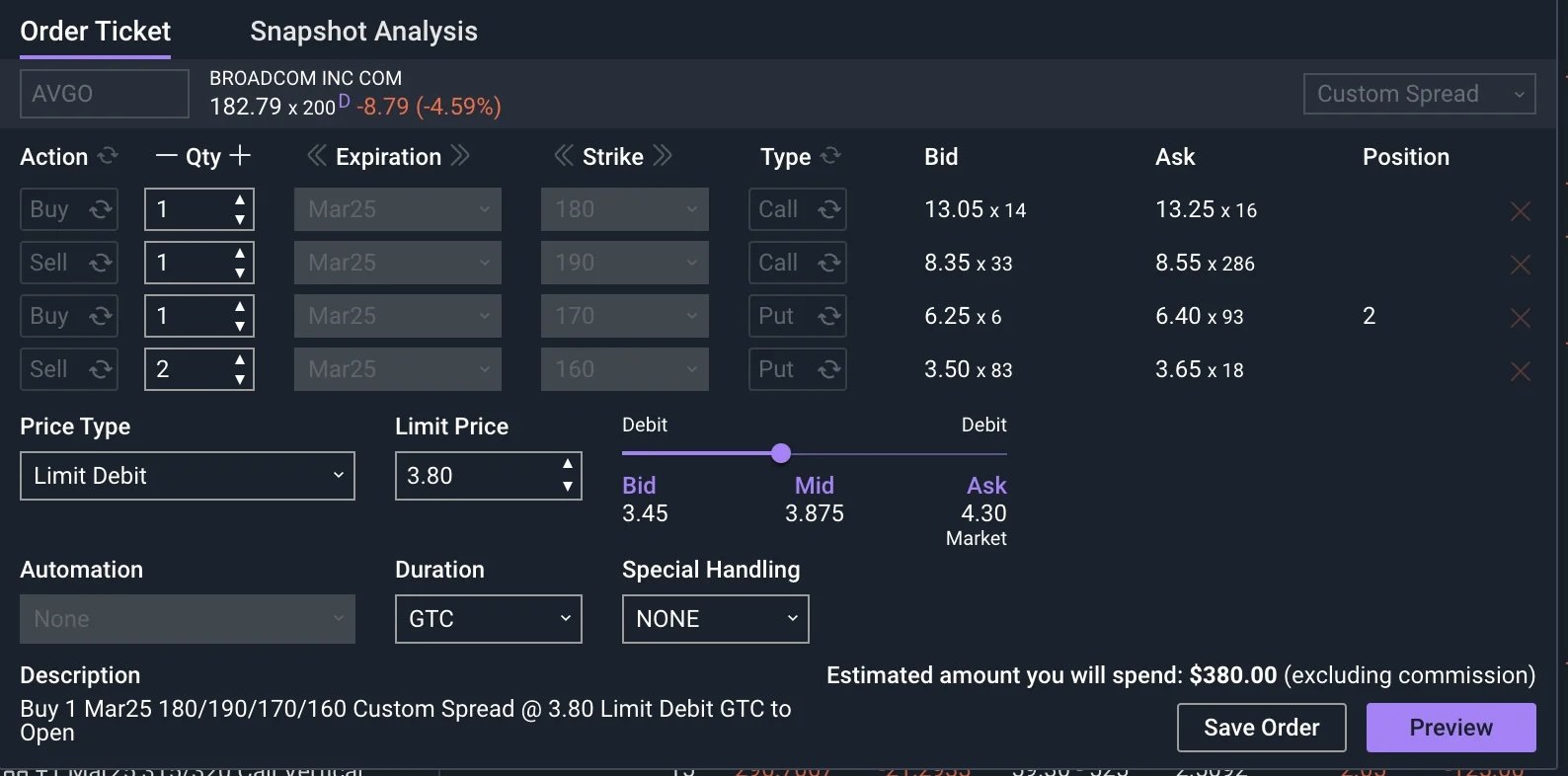

A couple of AVGO earnings options plays

Earnings season means opportunity—and risk. With AVGO down 25% from its highs and an implied move of 8.7%, I’m eyeing a high-probability strategy that profits whether AVGO pops or drops. Instead of gambling on a single direction, I’m combining a bull call spread with a put ratio spread for a potential $600 profit while keeping risk in check. If AVGO tanks, I have a plan for that too. Full breakdown inside—how are you playing AVGO earnings?

MSTR trade idea to take advantage of recent 50% (!!) drop

How to Profit from MicroStrategys 50% Drop—Without Betting on a Rebound

MicroStrategy (MSTR) has taken a sharp 50% dive from its highs, but that doesn’t mean it’s a lost cause. With strong support around $250, there’s an opportunity to profit—even if the stock doesn’t skyrocket back up. Instead of simply buying shares and hoping for a rebound, options strategies can help you generate income while keeping the odds in your favor.

In this post, I break down a few options plays designed to take advantage of MSTR’s recent drop, along with profit/loss calculations. If you’re new to options, don’t worry—I’ve got a simple explanation to get you up to speed. Let’s dive in.

From Gambler to House - Third set of trades in educational portfolio

I opened new positions in AMZN, META, bringing the total positions to $5.5k potential profit on a $100k portfolio.

The full details of the portfolio and positions can be seen in the webinar. Would love to hear if this is a useful way to learn about options.

APP trade idea to take advantage of recent 40% drop

How to Profit from AppLovin’s 40% Drop—Without Betting on a Rebound

AppLovin (APP) has taken a sharp 40% dive from its highs, but that doesn’t mean it’s a lost cause. With strong support around $300, there’s an opportunity to profit—even if the stock doesn’t skyrocket back up. Instead of simply buying shares and hoping for a rebound, options strategies can help you generate income while keeping the odds in your favor.

In this post, I break down a few options plays designed to take advantage of APP’s recent drop, along with profit/loss calculations. If you’re new to options, don’t worry—I’ve got a simple explanation to get you up to speed. Let’s dive in.

2 New trades for portfolio

1️⃣ Taking advantage of market dips: NVDA’s historic $600B drop presented an opportunity—I sold a Jan 2026 $100 put for a potential 43% return on margin.

2️⃣ Being the house, not the gambler: PYPL’s post-earnings dip allowed me to sell puts with a 72% probability of profit, locking in upfront cash while managing risk.

3️⃣ Building the portfolio strategically: With ~$2K added in premium, I’ll continue layering in trades—next month, I’ll explore a different strategy. Stay tuned! 🚀

How to Be the House - not the Gambler

Stock options add an element of time to the equation, and while stocks can go up or down, time only goes forward. And the addition of the element of time enables you to profit from the certainty of time going by. How exactly? Read on.

Portfolio first update

A week and a half have gone by since opening the portfoilo and making the first trades. Obviously not much has changed, it really takes at least a month or 2 for significant time decay on the strategies we opened with, but overall the US markets haven’t had a good start of the year - with the nasdaq and S&P each down over 2%.

Portfolio launch and first trades

New portfolio guiding principles

I will focus on simple to understand, low maintenance options strategies for this portfolio which will make it very easy to calculate investment size and potential gains/losses. I will make the trades in real time at real prices via webinar, where I will talk through the position itself, including investment size, best/worst case, and what I will do if the stock goes against my position. Sign up for an invite link to the webinar.

Introducing the $100k Open Portfolio: A Teaching Tool for new Investors

I’m excited to announce the launch of the Beyond Stocks: $100k Open Portfolio! This portfolio is more than just a collection of trades—it’s a practical, hands-on teaching tool designed to show you how to navigate the world of options investing with confidence and clarity.